Manage Money Wisely in a World Relentlessly Urging You to Spend

I used to think that learning how to manage money wisely is about as exciting as watching snooker on TV. I also believed that money management and keeping track of money are miserable spoilsports. What can I say, I have a strong hedonistic streak – I believe it is…

Cheap Lunch Ideas: How to Lunch Like a King on a Tight Budget

You pick up your sandwich, crisps and drink and hand over your five-pound note while your mind screams that this is too much. You need cheap lunch ideas to nourish your body (and soul) to stop paying too much for unhealthy food. But is it possible to eat like…

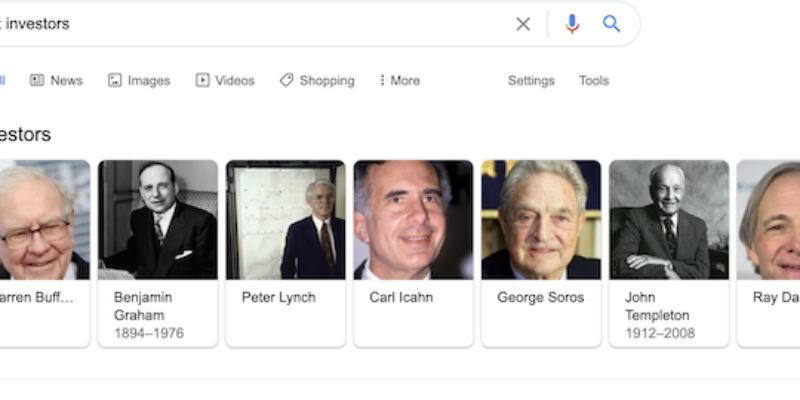

Turbocharge Your Investment Portfolio (& Invest Like the Wealthy)

Ever felt like your investment portfolio performance is stuck in a vanilla rut while the big players are feasting on exotic flavours? Are you wondering how the Joneses (or, in this case, the Buffetts) keep their investment portfolios in excellent condition? I was perplexed as well, so I did…

Why You Should Open an ISA Now (& Start Wealth Building)

Do you hesitate to open an ISA because of… the economy, your finances, you don’t understand what this is… There are many reasons why you may wish to delay opening an ISA. And only one reason why you should do it immediately – ISA is an invaluable financial instrument…

Financial Freedom at Your Fingertips (Rise of FinTech)

In today’s fast-paced digital age, traditional banking is no longer the only option for managing your finances and achieving financial freedom. The rise of tech-driven financial services has revolutionized how people interact with their money, providing unprecedented control and convenience. Tech-driven financial services are at the forefront of this…

Women Investing Inspiration – Hetty Green, the She-Wolf of Wall Street

It is a truth universally accepted that women investing is a problem. In the realm of finance, the narrative around women and investing has often been overshadowed by misconceptions and a lack of representation. Contrary to the dated notion that women primarily spend on trivial things, we know that’s…

How Our Bank Dropped the Ball (& What It Meant for Us)

We trust banks to keep our money safe and look after basic stuff. Like closing our loan account when debt is paid off. Transferring money when we purchase stuff and crediting our accounts when money goes in. We trust banks not because we know what they do and how…

How Important is a Catchy Business Name for Entrepreneurs?

Despite the rising challenges the UK economy faces, it is still a great time to start a business. Plenty of resources make entrepreneurship more accessible than ever, and many entrepreneurs surveyed by Oneday still note that it’s an excellent time to start your endeavour. A lot of people still…

Invest Small, Gain Big: The Surprising Path to Financial Security

So, do you think you need to swim in cash to invest and be on a path to financial security? You’ve probably glared at ads about investing in your future and thought, “Nice, but where should this ‘extra money’ come from?” Let me respectfully shatter your doubts. You could…

Mastering Personal Finance: A Guide to Financial Freedom

Suppose you struggle to get your finances in order and dream of attaining financial independence but don’t know where to begin. In that case, you can start mastering personal finance with proper advice and guidance. By establishing a solid foundation of financial literacy, you can achieve financial stability and…

10+ Healthy Money Habits to Kick-start Your Turnaround

You will learn about thirteen healthy money habits to help you kickstart your financial turnaround. These habits are the immutable foundation of financial health. You’re working hard, yet you’re not making progress. Every payday feels like a fresh breath until the bills, the debts, the unexpected expenses – come…

Can You Get a Mortgage With Debt? Exploring Your Options

Securing a mortgage is a significant milestone on the path to homeownership. However, for individuals burdened with existing debt, it’s normal to have questions, such as: Can you get a mortgage with debt? How does equity release work? This article will delve into this topic and explore the options…