Retirement Calculator and How Much do You Need for retirement

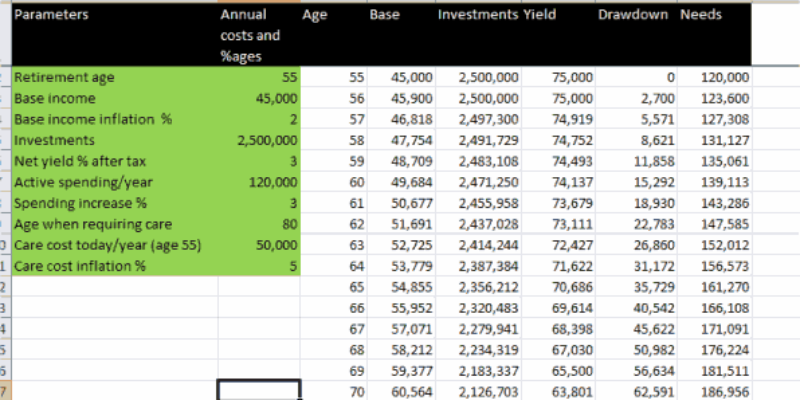

Yesterday Maria published a post suggesting that for a fulfilled life in our pre-dotage before we are off to the commune, we will need to amass a net worth of some £2.5 million ($4 million) of savings and investments over the next 5 years. This is our retirement, not…

Are you saving too much: where is your ‘enough’?

I know, I know! In a realm where saving is a major virtue – bordering on dogma – this question may sound as heresy. Nevertheless, it keeps popping up in my mind lately: can we be saving too much? Surprisingly, or not, my answer is: yes, we can be saving…

Beyond ‘I told you so’ is ‘Ouch!’: book review of Paul Knott’s epic book about finance and so much more

This is a very no-traditional book review of a non-traditional and epic book on personal finance. Whenever I read a book on (personal) finance I can put it, and its author, in a neat ‘cubby-hole’. Yes, it comes with experience but I have read quite a few of those. In…

Budget airlines and out of pocket passengers: easyJet let us down

As budget airlines go, I have a lot of time for easyJet. The company is profitable yet competitive, runs a very efficient operation, fast turn-round, full flights and is changing to booked seats, getting rid of the dreaded seat scramble. Our direct 18.25 Manchester to Geneva flight last Friday should…

Do you believe in coincidences? The marathon that was not to be!

I trained hard and I trained long! I had the flu and it kept coming back for three weeks before the marathon date – I still thought that I will run it; or at least that I will start it. Then about a week ago I checked the forecast for…

Changing my position on credit cards: a sign of weakness or growth

Last night I was talking to one of my sons – the one who is in his mid-twenties – and what struck me was the unmovable convictions he had on many issues. We were talking about writing because he is the one in the family with real talent; heck,…

Busy or productive: 2,000 to 10,000 or how to catapult your writing productivity

Have you heard about Rachel Aaron? I won’t be surprised if you have not – after all she is a writer and a reputedly a good one since she manages to make a living with it. Until about a year ago when I came across her website – Pretentious Title…

Principled Money Posts #25: ‘being fifty and mad celebrations’ edition

It has been a week since I hit fifty; how is it? Great! It is the time of life when we are suspected of having mid-life crisis and, this applies more to us women, menopausal. As I say, it is the same as being in puberty but so much better…

Our financial optimism: ‘no spending’ to ‘home improvements’

Well, I didn’t tell you that but last Saturday (13 October) was my 50th birthday. I am becoming an ‘old bird’, indeed. Apart from having to work on that day and receiving many messages of congratulation this has a very special meaning for me. Three years ago we first found…

How has the eurozone crisis affected corporate banking?

Banks have been having a bad press recently. My views on the causes are probably better kept out of this article but don’t tar all banks, let alone bankers, with the same brush. Love them or hate them, we need them. In fact we have good reason to be very…

Changing people’s hearts and minds: the magic and practice of enchantment

Couple of days ago my work bought me a new laptop; this was not a privilege but necessity. My new ‘production tool’ is a Samsung, sleek, thin and light, and works like a dream (well, there is no need to get technical). It also looks very much like a Mac;…

Why comparing your budget to this of other people is a really dumb thing to do

Recently I came across a post on a public forum that provided a Statement of Affairs (for my readers in the US this is a tool that sets out income, expenditure, assets and liabilities) and asked how does this compare with the budgets of other people. Of course, people jumped…