Does it have to be so complex? Three mental shifts to simplify your financial life

Lately, I have noticed that my life has become a bit harder! Now some may attribute this to the on-going economic crisis – we have already been through a double dip recession and are confidently marching into a triple dip one; which is a way for economists, finance buffs and…

Is Getting in Debt the Best Thing That Could Have Happened to Me? Really?

I would have never thought that getting in debt may have been the best thing to happen to me but my friend Alison may be onto something. Several years back I was driving a bright yellow Smart Fortwo with grey sidebars. Sweet! All my friends were rather surprised. This…

What to Ask Ourselves Before Taking Out a Consolidation Personal Loan

Ideally, we shouldn’t even think about taking out a consolidation personal loan! At the same time many of us need a little help with our cash flow from time to time or to get the big stuff in life – houses, for instance. Similarly, as somebody said in a…

Unifying investments – Bring an ISA and a SIPP together

This is a Guest Post by Clive and I decided to publish it to signal my refocusing interests. I hope many of my readers find the article informative and useful. The current financial markets around the globe continue to be extremely volatile. This volatility requires an investor to closely monitor…

Buy what you need when you need it!

Sometimes we are persuaded to do things ourselves and there is merit in that. I have every admiration for people who can spend their time plastering and building, wiring and plumbing not to mention gardening. Our German friend, who lives in the UK, tells us that in Germany, you are…

One habit of wealthy people

Habits of wealthy people, as well as the habits that help us become wealthy, are much discussed on personal finance blogs. There have been a numerous posts on the ‘five habits of millionaires’, ‘the habits that will make you and keep you rich’ and even the psychology of wealth. I…

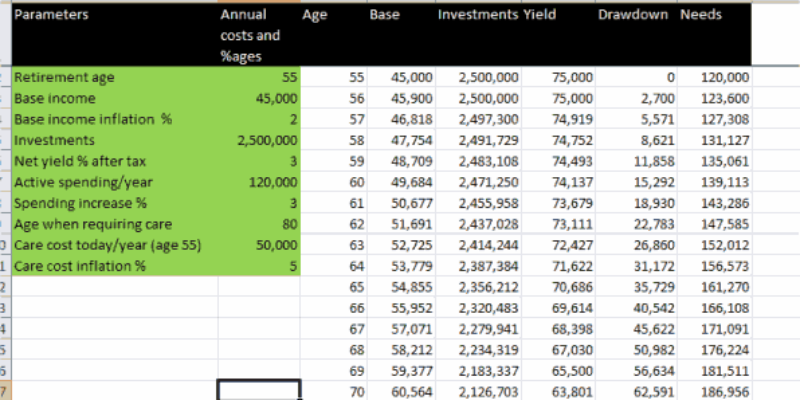

Retirement Calculator and How Much do You Need for retirement

Yesterday Maria published a post suggesting that for a fulfilled life in our pre-dotage before we are off to the commune, we will need to amass a net worth of some £2.5 million ($4 million) of savings and investments over the next 5 years. This is our retirement, not…

Are you saving too much: where is your ‘enough’?

I know, I know! In a realm where saving is a major virtue – bordering on dogma – this question may sound as heresy. Nevertheless, it keeps popping up in my mind lately: can we be saving too much? Surprisingly, or not, my answer is: yes, we can be saving…

Beyond ‘I told you so’ is ‘Ouch!’: book review of Paul Knott’s epic book about finance and so much more

This is a very no-traditional book review of a non-traditional and epic book on personal finance. Whenever I read a book on (personal) finance I can put it, and its author, in a neat ‘cubby-hole’. Yes, it comes with experience but I have read quite a few of those. In…

Budget airlines and out of pocket passengers: easyJet let us down

As budget airlines go, I have a lot of time for easyJet. The company is profitable yet competitive, runs a very efficient operation, fast turn-round, full flights and is changing to booked seats, getting rid of the dreaded seat scramble. Our direct 18.25 Manchester to Geneva flight last Friday should…

Do you believe in coincidences? The marathon that was not to be!

I trained hard and I trained long! I had the flu and it kept coming back for three weeks before the marathon date – I still thought that I will run it; or at least that I will start it. Then about a week ago I checked the forecast for…

Changing my position on credit cards: a sign of weakness or growth

Last night I was talking to one of my sons – the one who is in his mid-twenties – and what struck me was the unmovable convictions he had on many issues. We were talking about writing because he is the one in the family with real talent; heck,…