6 Beginner Tips for Creating a Personal Budget That Works

Anyone serious about solving their financial woes, saving more each month, or simply gaining a better understanding of where their money is going, need to get on with creating a personal budget. According to CNBC, 81% of Millennials save, and many attribute their saving habits to having a personal budget…

Five Ways to Make Your Money Work for You

Here are the five ways to make your money work for you: Invest in the stock market and other financial instruments (e.g. equities, bonds, mutual funds, ETFs) Invest in luxury goods (e.g. art, sports cars, whisky and wine, precious stones) Invest directly in business (buy into a local business) Invest…

What Being Frugal Means to 17 Money Mavericks

Being frugal with creativity and flare is a virtue. Frugal life is about being mindful with money, energy and time. Frugality is a test of what you value in your life and is empowering. My grandmother was extremely frugal. She grew her own food, never wasted anything and viewed…

5 Ways a Later Life Mortgage Can Improve Your Life (And Make Your Family Adore You)

There are benefits to having a later life mortgage ranging from preparation for your golden years to benefaction and preserving the possibility to borrow. As usual with money, there are also mistakes you must avoid. Benefits and mistakes are set out in this post. “My new apartment is lovely. Unfortunately,…

Innovative Finance ISA: What You Need to Know About It and How It Compares with ISAs

Innovative Finance ISA allows you to use some of, or all, your ISA tax-free allowance to invest with a variety of lending platforms. In the same tax year, ending on 5 April, you can invest in one Cash ISA, one Stocks, and Shares ISA and one IFISA. IFISA, on the…

How Much Money Do You Need to Retire Comfortably?

Photo by Harli Marten on Unsplash Research shows an average retired couple in the UK spends £26,000 annually to retire comfortably. How much do you need to retire comfortably depends on the life you want in retirement? Estimate how much money do you need to retire comfortably by estimating your…

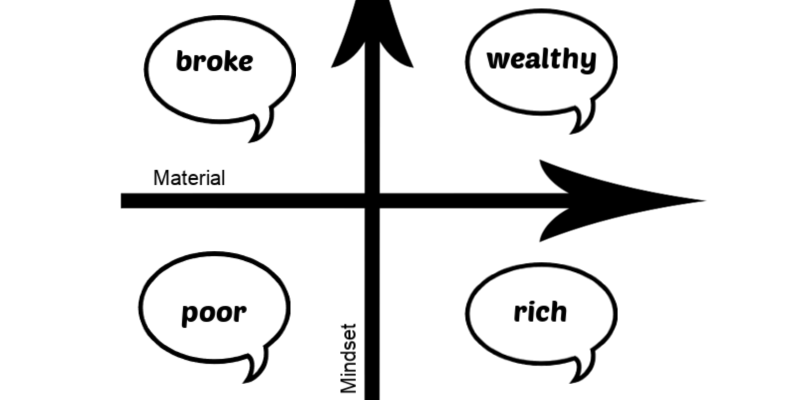

Why You Would Never be Wealthy if You are Poor

Today I’ll share one of the secrets of financial health, namely the importance of your mindset for your financial destiny. You know that I’m very keen on maintaining my financial health and helping others to become, and keep, financially healthy. For me, financial health combines material wealth, emotional well-being…

Four Ways to Organise Family Finances (and Why We Share All)

Deciding how to organise family finances is not as straightforward as it used to be. My mum and dad, for example, didn’t need to make complex decisions about that: my dad worked, my mum looked after the children and all money was shared. There is also the part where my…

How Much Money You Need to Change Your Life

Today I ask you how much money you need to change your life. You can answer by: Working out where you stand now according to material wealth and emotional wellbeing. Deciding where you wish to be. Examining your motivation. Estimating how much money you need to achieve the change. …

Guide to ISA: the good, the savvy and the little known rules of ISA

This guide to ISA will help you learn: What is an ISA? What ISAs you can choose from? Why you should open an ISA immediately? How to select the best ISA for you? What are the little known rules of ISA you must hear about? I’m chilling, soaking in…

Heroic Mythology About Investing and Why You Must Not Fall for It

Do you remember the myth of Sisyphus? (Yes, this is the dude who was punished to push a rock to top of a mountain for eternity). You have probably heard about Icarus who, while escaping from an island using wings made with wax, dared to fly too close to the…

27 Sure Fire Ways to Turn Wealth into Wellbeing

Introduction Today I’d like to chat about ways to transform wealth into wellbeing. Why do we need to talk about that? Two reasons, really. First, wealth matters little if it doesn’t nourish our lives and contribute to our wellbeing. And second, in our pursuit of wealth, we often forget the…