How to Pay off Debt (10 Savvy Steps for Fast Results)

You dream about debt freedom and the thing left to figure out is how to pay off debt. I get it. Dream, line and sinker. Living under a mountain of debt is stressful. For years Ostrich has been your favourite yoga pose. You have buried your head in Netflix shows,…

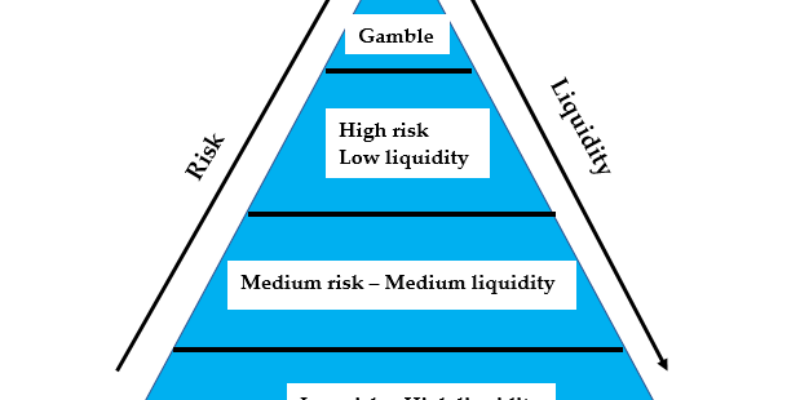

The Net Worth Pyramid and Why It Is So Important for You

In this post I share a simple idea to help you look at your net worth (your estate) and make decisions about improving it. The ‘net worth pyramid’ uses two characteristics of wealth – risk and liquidity – to bring some order into the uncertain territory of assets, investments, possessions…

How to Sort Out Your Pension with Ease and Efficiency

You know you should sort out your pension. I’m not talking only about the monthly sum going into your pension fund. Here, I’m talking about finding all these pension pots you forgot about long ago and finding the best deals around. Do you want to know how you can get…

9 Essential Starting Points to Paying Debt You Have Not Heard Mentioned

Congratulations! You have committed to paying debt. And this time is different, right? Still, you find yourself shrouded in confusion. Where do you start paying debt? What do you do first? I have been where you are now. Do you know what was the first thing I did when…

A Brief Note on Passive Income: Forever Nirvana or a Wild Goose Chase

Passive income is a tantalising prospect. When it comes to reality and making real cash, things can resemble a wild goose chase rather than a ‘forever’ nirvana. There is a lot of talk in the media about passive income. It is presented as the panacea that will allow us…

5 Excellent Reasons to Celebrate Your Debt While Paying It Off

Have you considered learning to celebrate your debt? I bet you haven’t. I bet you spend your time vilifying, hating, and fearing your debt. You are not alone. Most of us, who have real-life experience with enormous debt, have swum in the ocean of negativity that comes with realising…

The Money Principle Manifesto Revisited

Dear friends of The Money Principle, With this post, I am going back to the beginning. You may not remember or know that, but this site used to be where I shared with you my thoughts, struggles, and life (such as it is). When I did that, my heart…

Pay Off Debt Inpiration From Someone Who Paid Off £21,000

Editor’s note: Today I offer you the story of one couple who are pay off debt inspiration – they paid off £21,000 in eight months. Ruth, who blogs at MoneySavvyMumUK.com, and her husband tell a powerful story of money success, learning and progress, and hope for the future of…

How to Make Buying a Car an Investment

We’re told that the minute you drive a new car off the lot, the value goes down significantly; the question is, can we make buying a car an investment? So, how do you make a necessity that is bound to lose value into a worthy investment? It all depends…

Pros and Cons of Debt Consolidation

When we were in debt, we didn’t even have the luxury to consider the pros and cons of debt consolidation. We had to consolidate because we had so much debt that simply paying the credit card minimum payments was pushing us further into debt. We didn’t stop to think,…

Planning An Early Retirement?

If early retirement was possible, most of us would do it. But how can it be achieved? Here are some tips to retire sooner rather than later. How to plan for an early retirement Retirement, it’s something many of us don’t think about. Why isn’t it covered in the…

Living a Frugal Life Now Can Have Lots of Long-Term Perks

Living a frugal life means being very rational and intentional with your spending. It involves prioritising your spending on things that matter the most and cutting back on those that don’t. Living frugally can have different meanings to different people. However, it does not necessarily mean choosing a staycation…