At the start of each year, I conduct my money housekeeping exercises, confronting reality even when it is daunting. One may be reluctant to face what is uncovered.

Today, my friends is the day to reflect on 2024 and see how we did.

I will follow the “Essential Money Housekeeping” template to examine our income, spending, savings, and investments.

I shall refrain from considering our debt. As you know, we have no liabilities apart from the mortgage, which we are not fixating on since it constitutes a small fraction of the house’s value.

So, here is a frank look at our finances in 2024.

[If you would like a reminder of why money housekeeping is important and how to conduct it, please read this.]

How Much Money We Made in 2024?

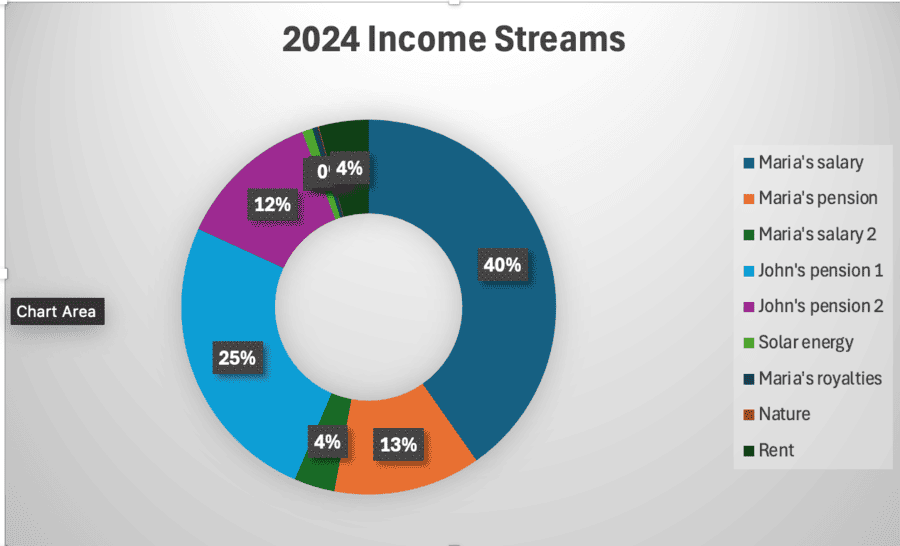

In 2024, we had nine income sources.

Naturally, these brought in very different amounts, the largest being my part-time professorial salary and the smallest the £85 Nature paid me for an article.

We brought in high five figures (after tax) between John and myself.

Here is a pie chart illustrating our income sources and the corresponding amounts they generated.

Looking at the chart, my salary (50% professorship) still constitutes a substantial part of our income. Looking to the future, I should either continue my employment or start a business that will replace and even increase my income.

Our Expenses for 2024

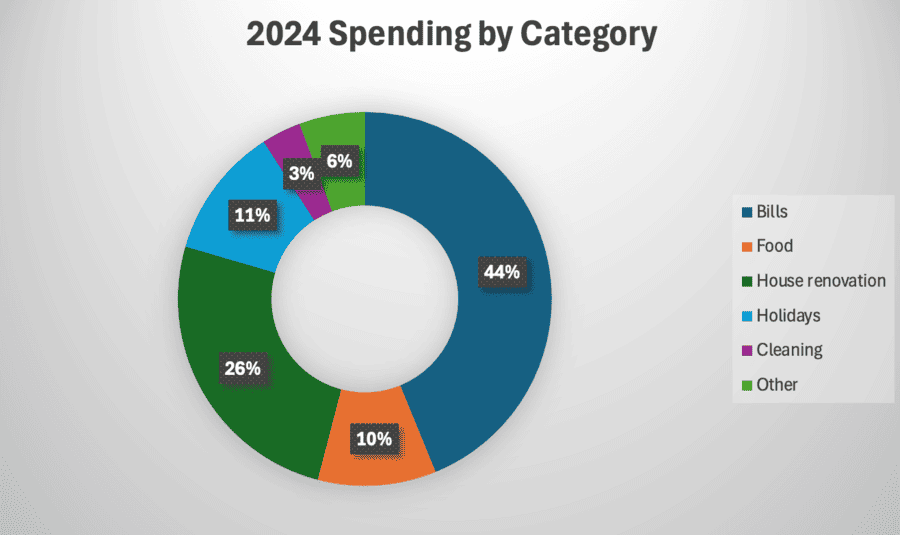

This year, our analysis of expenditure is not as thorough as in previous years. For example, the ‘bills’ category includes all regular outgoings apart from food and cleaning, such as mortgage, insurance, gym membership, entertainment, council tax, energy, water, medical and dental insurance, and charitable donations.

Hence, slightly less than our annual spending is on ‘bills’.

Another 10% of spending is on food. This category has increased as a proportion of spending largely because of the rising prices of food and our son living with us again.

Holiday Spending

I will not argue about our holiday spending and cleaning—yes, it is considerable, but it is worthwhile. Our three weeks in the sun (our annual holiday in Skiathos) are divine—sunshine, healthy and delicious food, and time to reconnect as a family. I come back healthy and fit after swimming a kilometre each day.

House Renovation Spending

This spending is probably better placed under ‘investing and investments’.

We have a lovely house built in 1904 (plus/minus two years). Old houses need regular maintenance and investments. Being pragmatic people, we have always invested more in infrastructural changes to the house than in decoration, making it pleasant to live in.

For instance, we have double glazing, a new roof, solar panels, new bathrooms, and fresh pointing. However, several years ago, we experienced what I refer to as ‘a flood from the side’ when, due to particularly heavy rain and faulty pointing, four rooms in the house were damaged.

Last year, we renovated the whole ground floor of our house (except the kitchen), including the sitting room, dining room, study, and downstairs bathroom.

Everything was redecorated to a high standard, partitions built and wooden floors installed.

Here are some pictures.

Yes, this constitutes 26% of our spending last year, but:

- We got an exceptionally good deal, and all work and materials cost less than £19,000.

- The house looks stunning, and we love living here.

- Our energy bills are much lower; I never realised how much heat leaves through the carpeted floor.

This is an investment on two fronts: lower energy bills and an increase in the house’s value.

Other Spending

This category is mainly about spending on sons.

Our youngest graduated last summer, and there were expenses for his graduation (including buying him a nice suit as a present). Apart from that, he is working on building his business.

I understand what launching a start-up company requires—it involves hard work, focused dedication, and stress (the positive kind). We have assisted in every way possible, including lending him money for small business-related expenses.

Savings and Investments

Our investments – Vanguard S&S ISA – are up 24% this year. This is a decent return.

Our savings are also up, but given the spending on the house, it is not as much as I would have expected.

(I need to examine our spending on other items going through the Virgin CC. Probably there is some slippage there.)

What Does Our Money Housekeeping Tell Me?

Our cash reserves (savings and liquid investments) are down.

Part of that is paying a large portion of the mortgage when interest rates were high, and another part is spending money on the house.

I won’t lie to you – this concerns me.

Ten years ago, when we had just paid off our consumer debt, I swore we’d never be without cash.

In 2025, I must establish financial discipline again, especially because we plan to renovate the kitchen.

Watch this space, and I’ll keep you posted.